SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| ý | Filed by the Registrant | |

o | Filed by a Party other than the Registrant | |

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

VISTA GOLD CORP. | ||||

(Name of Registrant As Specified In Its Charter) | ||||

NOT APPLICABLE | ||||

(Name of Person(s) Filing Proxy Statement if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

VISTA GOLD CORP.

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION

AND PROXY CIRCULAR

for the

Annual General Meeting

to be held on

Monday, May 10, 20049, 2005

The attached Notice of Meeting, Management Information and Proxy Circular, and form of proxy and notes thereto for the Meeting are first being sent to shareholders of the Corporation on or about April 1, 2004.2005.

March 17, 20042005

Dear shareholder:

It is my pleasure to invite you to attend the annual general meeting of shareholders to be held on Monday, May 10, 20049, 2005 at 10:00 a.m., Vancouver time, at the offices of Borden Ladner Gervais LLP, Suite 1200, 200 Burrard Street, Vancouver, British Columbia, Canada. If you are unable to attend this meeting in person, please complete, date, sign and return the enclosed form of proxy to ensure that your vote is counted.

The Notice of Meeting, Management Information and Proxy Circular and formsform of proxy and notes thereto for the meeting, together with a reply card for use by shareholders who wish to receive the Corporation's interim financial statements, are enclosed. These documents contain important information and I would encourage you to read them carefully.

Yours truly, | ||||

(Signed) | President and Chief Executive Officer | |||

i

VISTA GOLD CORP.

NOTICE OF MEETING

NOTICE IS HEREBY GIVEN THAT the 20042005 annual general meeting (the "Meeting") of the shareholders of Vista Gold Corp. (the "Corporation") will be held at the offices of Borden Ladner Gervais LLP, Suite 1200, 200 Burrard Street, Vancouver, British Columbia on Monday, May 10, 20049, 2005 at 10:00 a.m., Vancouver time, for the following purposes:

Accompanying this Notice of Meeting are (i) a Management Information and Proxy Circular, (ii) a form of proxy and notes thereto, and (iii) a reply card for use by shareholders who wish to receive the Corporation's interim financial statements.

If you are aregistered shareholder of the Corporation and are unable to attend the Meeting in person, please date and execute the accompanying form of proxy for the Meeting and deposit it with Computershare Trust Company of Canada at 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, before 4:30 p.m., Toronto time, on Thursday, May 6, 2004,5, 2005, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

If you are anon-registered shareholder of the Corporation and receive these materials through your broker or another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or such other intermediary.

This Notice of Meeting, the Management Information and Proxy Circular, the form of proxy and notes thereto for the Meeting, and the reply card are first being sent to shareholders of the Corporation on or about April 1, 2004.2005.

DATED at Littleton, Colorado, this 17th day of March, 2004.

BY ORDER OF THE BOARD OF DIRECTORS | ||||

(Signed) | President and Chief Executive Officer | |||

ii

LETTER TO SHAREHOLDERS | i | |||

NOTICE OF MEETING | ii | |||

MANAGEMENT INFORMATION AND PROXY CIRCULAR | ||||

| Particulars of Matters to be Acted Upon | 1 | |||

| Election of Directors | 1 | |||

| Appointment of Auditors | 3 | |||

| Amendment to Stock Option Plan | 4 | |||

| Information About Proxies | ||||

| Solicitation of Proxies | ||||

| Appointment of Proxyholder | ||||

| Revocation of Proxy | ||||

| Voting of Proxies | ||||

| Exercise of Discretion by Proxyholders | ||||

| Securities Entitled to Vote | ||||

| Ownership of the Corporation's Common Shares | ||||

| Ownership by Management | ||||

| Ownership by Principal Shareholders | ||||

| Quorum | ||||

| Corporate Governance | ||||

| Committees of the Board of Directors and Meetings | ||||

| Audit Committee Report | ||||

| Executive Compensation | ||||

| Summary Compensation Table | ||||

| Long-Term Incentive Plan | ||||

| Stock Options | ||||

| Pension and Retirement Savings Plans | ||||

| Termination of Employment, Change in Responsibilities and Employment Contracts | ||||

| Compensation Committee Interlocks and Insider Participation | 17 | |||

| Report of the Compensation Committee on Executive Compensation | 17 | |||

| Performance Graph | ||||

| Compensation of Directors and Officers | ||||

| Securities Reserved For Issuance Under Equity Compensation Plans | 20 | |||

| Indebtedness of Directors and Senior Officers | ||||

| Director and Officer Liability Insurance | ||||

| Interest of Management and Others in Material Transactions | ||||

| Management Contracts | ||||

| Interest of Certain Persons in Matters to be Acted Upon | ||||

| Shareholder Proposals | ||||

| Other Matters | ||||

| Dissenters' Rights of Appraisal | ||||

| Section 16(a) Beneficial Ownership Reporting Compliance | ||||

| Availability of Documents | ||||

| Multiple Shareholders Sharing the Same Address | ||||

| Board of | ||||

| Schedule "A"— Resolution to Approve Amendment to Stock Option Plan | A-1 | |||

| Schedule "B" — Stock Option Plan | B-1 | |||

| Schedule "C" — Alignment with TSX Corporate Governance Guidelines | ||||

| Schedule | ||||

i

MANAGEMENT INFORMATION AND PROXY CIRCULAR

This Management Information and Proxy Circular ("Information Circular") is furnished in connection with the solicitation by the management of Vista Gold Corp. (the "Corporation") of proxies to be voted at the annual general meeting (the "Meeting") of the shareholders of the Corporation ("shareholders") to be held at the offices of Borden Ladner Gervais LLP, Suite 1200, 200 Burrard Street, Vancouver, British Columbia on Monday, May 10, 20049, 2005 at 10:00 a.m., Vancouver time, for the purposes set forth in the accompanying Notice of Meeting.

It is anticipated that this Information Circular and the accompanying form of proxy will be first mailed to shareholders on or about April 1, 2004.2005. Unless otherwise stated, the information contained in this Information Circular is given as at March 17, 2004.2005.

The executive office of the Corporation is located at 7961 Shaffer Parkway, Suite 5, Littleton, Colorado, U.S.A., 80127 and its telephone number is (720) 981-1185. The registered and records office of the Corporation is located at 200 - 204 Lambert Street, Whitehorse, Yukon Territory, Canada, Y1A 3T2.

Advance notice of the Meeting was published in The Vancouver Sun newspaper on March 24, 2005, The Toronto Star newspaper on March 27, 2005 and The Whitehorse Star newspapersnewspaper on March 22, 2004.28, 2005.

Information regarding the proxies solicited by management in connection with the Meeting is set out below under "Information About Proxies".

Particulars of Matters to be Acted Upon

Election of Directors

The directors of the Corporation are elected at each annual general meeting and hold office until the close of the next annual general meeting or until their successors are duly elected or appointed. Management proposes to nominate each of the following five persons for election as a director of the Corporation. Proxies cannot be voted for a greater number of persons than the number of nominees named.In the absence of instructions to the contrary, the enclosed form of proxy will be voted for the nominees listed below.

Information concerning the five nominees, as furnished by them individually, is set forth below.

| Name, Residence, Position and Age | Principal Occupation, Business or Employment(1) | Director Since | Number of Shares Held(2) | ||||

|---|---|---|---|---|---|---|---|

JOHN M. CLARK(3)(4)(5) Toronto, Ontario Director Age— | Chartered Accountant; President of Investment and Technical Management Corp., a firm engaged in corporate finance and merchant banking, from February 1999 to present; independent consultant providing investment and management advisory services from February 1998 to January | May 18, 2001 | 80,000(6) | ||||

1

Director Age— | Businessman: President | ||||||

C. THOMAS OGRYZLO(3)(4)(5) San Jose, Costa Rica Director Age— | Businessman; | March 8, 1996 | 70,000 | ||||

ROBERT A. QUARTERMAIN Vancouver, British Columbia Director Age— | Geologist; President and Chief Executive Officer of Silver Standard Resources Inc., a silver resource company, from January 1985 to present. | April 26, 2002 | 172,465 | ||||

MICHAEL B. RICHINGS Fort Ludlow, Washington Director Age— | May 1, 1995 | 115,000 |

2

The information as to the municipality of residence, principal occupation and number of Common Shares owned by the nominees listed in the above table is not within the knowledge of the management of the Corporation, and has been furnished by the individual appointees as of March 17, 2004.2005.

There are no family relationships among any of the above directors of the Corporation. No directors of the Corporation are also directors of issuers with a class of securities registered under Section 12 of the United StatesSecurities Exchange Act of 1934 (the "Exchange Act") (or which otherwise are required to file periodic reports under the Exchange Act) except for Robert Quartermain, who is a director of Silver Standard Resources Inc., Canplats Resources Corporation, Esperanza Silver Corp. and IAMGold Corp.

None of the above directors has entered into any arrangement or understanding with any other person pursuant to which he was, or is to be, elected as a director of the Corporation or a nominee of any other person, except that Mr. Quartermain was initially appointed to the Board of Directors as a nominee of the holders of the Corporation's convertible debentures issued as part of the private placement transaction that was completed in February and March, 2002. The largest single holder of debentures, all of which have since been converted to equity pursuant to their terms, was Exploration Capital Partners 2000 Limited Partnership, whose General Partner, Resource Capital Investment Corp., is 90% owned by a trust of which A. Richards Rule is co-trustee. Mr. Rule beneficially owns approximately 13%9.1% of the Common Shares of the Corporation. See "Ownership of the Corporation's Common Shares". Additional information regarding the various committees of the Board of Directors, and the attendance of each director at meetings of the Board of Directors and its committees held during 2004, is set out below under "Corporate Governance—Committees of the Board of Directors and Meetings". This nomination related only to Mr. Quartermain's initial appointment as a director. There is no subsequent arrangement or understanding pursuant to which Mr. Quartermain was, or is to be, elected as a director of the Corporation. Additional information regarding the various committees of the Board of Directors, and the attendance of each director at meetings of the Board of Directors and its committees held during 2003, is set out below under "Corporate Governance—Committees of the Board of Directors and Meetings".

Appointment of Auditors

Unless otherwise instructed, the proxies given pursuant to this solicitation will be voted for the re-appointment of PricewaterhouseCoopers LLP, Chartered Accountants, of Vancouver, British Columbia, as the auditor of the Corporation to hold office until the close of the next annual general meeting of the Corporation or until a successor is appointed. It is proposed that the remuneration to be paid to the auditor be fixed by the Audit Committee of the Board of Directors. PricewaterhouseCoopers LLP (then Coopers & Lybrand) was first appointed the auditor of the Corporation on June 28, 1985.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Meeting and to be available to respond to appropriate questions from persons present at the Meeting. If representatives of PricewaterhouseCoopers LLP are present at the Meeting, the Chairman of the Meeting will provide such representatives with the opportunity to make a statement if they so desire.

3

Fees Paid to Auditors and theirTheir Independence from the Corporation

The Corporation retained PricewaterhouseCoopers LLP to provide services which were billed for the yearyears ended December 31, 20032004 and 20022003 in the following categories and amounts:

| (in Canadian dollars) | 2003 | 2002 | 2004 | 2003 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Audit Fees(1) | $ | 79,500 | $ | 57,000 | $ | 124,500 | $ | 79,500 | ||||

| Audit Related Fees(2) | 2,500 | 1,000 | 800 | 2,500 | ||||||||

| Tax Fees(3) | 29,000 | 29,000 | 26,500 | 29,000 | ||||||||

| All Other Fees(4) | 0 | 0 | 0 | 0 | ||||||||

| Totals | $ | 113,003 | $ | 89,002 | $ | 151,800 | $ | 111,000 | ||||

The Audit Committee has adopted procedures requiring Audit Committee review and approval in advance of all particular engagements for services provided by the Corporation's independent auditors. Consistent with applicable laws, the procedures permit limited amounts of services, other than audit, review or attest services, to be approved by one or more members of the Audit Committee pursuant to authority delegated by the Audit Committee, provided the Audit Committee is informed of each particular service. All of the engagements and fees for 20032004 were approved by the Audit Committee. The Audit Committee reviews with PricewaterhouseCoopers LLP whether the non-audit services to be provided are compatible with maintaining the auditors' independence. The Board has determined that, starting in 2004, fees paid to the independent auditors for non-audit services in any year will not exceed the fees paid for audit services during the year. Permissible non-audit services will be limited to fees for tax services, accounting assistance or audits in connection with acquisitions, and other services specifically related to accounting or audit matters such as audits of employee benefit plans.

Amendment to Stock Option Plan

At the Meeting, the shareholders will be asked to consider and, if thought appropriate, approve by way of an ordinary resolution an amendment to the terms of the Corporation's Stock Option Plan adopted on November 1, 1996 and amended as approved by the shareholders on May 10, 1999 and May 2, 2003 (the "Current Plan"), to increase the maximum number of Common Shares that may be reserved for issuance upon the exercise of stock options issued to directors, officers and employees of the Corporation and its subsidiaries, and persons or companies engaged to provide ongoing consulting or other services for the Corporation or any of its subsidiaries. As at the date of this Information Circular, the Corporation had three executive officers (one of whom is a director), three non-employee directors, seven employees and 10 consultants, all of whom were eligible to receive awards under the Current Plan. Additional information about the Current Plan is set out below under "Executive Compensation—Stock Options".

The Current Plan provides that the maximum number of Common Shares which may be issued under the Current Plan shall be 1,000,000 Common Shares. The proposed amendment to the Current Plan would increase the maximum number of Common Shares which may be issued under the Current Plan to 1,750,000 Common Shares. This maximum number of Common Shares is subject to an adjustment mechanism to alter, as appropriate, the option price or number of shares issuable under the Current Plan upon a share reorganization, corporate reorganization or other such event not in the ordinary course of business which alters the share price or number of Common Shares outstanding.

Other than the options granted as described herein, subject to shareholder approval of the proposed amendment to the Current Plan, granting of options is discretionary and the Corporation cannot now determine the number of options that will be granted in the future to any particular person or group. As at March 1, 2005, the Board of Directors has granted options to purchase a total of 274,286 Common Shares, which is over and above the current 1,000,000 limit permitted under the Current Plan, as follows: W. Durand Eppler (Director)—50,000; Michael B. Richings (Director, President and Chief Executive Officer)—130,000; Warren Bates (Employee)—20,000; Howard Harlan (Vice President, Business Development)—20,000; Greg McCoach (Consultant)—5,000; David Mandy (Consultant)—5,000; Gonzalo Zavala (Consultant) —10,000; Victor Juvera (Consultant)—10,000; Thomas C. Doe (Consultant)—10,000; Pete Ellsworth (Consultant)—10,000; L. Steve Wagner (Consultant)—10,000. The exercise of these options is subject to the shareholders of the Corporation approving the proposed amendment to the Current Plan. On March 14, 2005, the closing price of a Common Share, as reported on the Toronto Stock Exchange (the "TSX"), was Cdn.$4.80 per share, and as reported on the American Stock Exchange, was U.S.$3.87 per share.

The Board believes that the amendment of the Current Plan is necessary and in the best interests of the shareholders in order for the Corporation and its subsidiaries to continue to attract and retain capable and experienced directors, officers and employees, as well as to provide incentives to other key service providers. In order to attract personnel who are capable and experienced and to align their compensation with the interests of the shareholders, the Corporation needs to be in a position to offer options to acquire Common Shares in excess of the 1,000,000 Common Share maximum under the Current Plan.

Shareholder approval of the proposed amendment to the Current Plan is required pursuant to the terms of the Current Plan and the rules and policies of the TSX. The rules and policies of the TSX further require that the amendment to the Current Plan must be approved by a majority of votes cast at the Meeting other than votes attaching to Common Shares beneficially owned by insiders to whom options under the Current Plan may be issued and their associates. As at March 17, 2005, the Corporation understands that a total of 5,000 votes will not be counted for the purposes of determining whether the required level of shareholder approval has been obtained for the amendment to the Current Plan.

The Corporation does not provide financial assistance to facilitate the purchase of Common Shares to directors, officers or employees of the Corporation or its subsidiaries, or persons or companies engaged to provide ongoing consulting or other services for the Corporation or any of its subsidiaries, who hold options granted under the Current Plan.

The text of the ordinary resolution to amend the Current Plan is set out inSchedule "A" to this Information Circular. The text of the Corporation's amended Stock Option Plan is set forth inSchedule "B" to this Information Circular.

U.S. Tax Information

Under U.S. tax law, a participant will not recognize taxable income upon the grant of a non-statutory stock option (i.e., an option that does not qualify as an "incentive stock option" under Section 422 of the U.S. Internal Revenue Code). Upon exercise of a non-statutory stock option, a participant generally will recognize ordinary compensation income in an amount equal to the excess of the fair market value of the common shares acquired through the exercise of the option ("Option Shares") on the exercise date over the exercise price.

With respect to any Option Shares, a participant will have a tax basis equal to the exercise price plus any income recognized upon the exercise of the option. Upon selling Option Shares, a participant generally will recognize capital gain or loss in an amount equal to the difference between the sale price of the Option Shares and the participant's tax basis in the Option Shares. This capital gain or loss will be a long-term gain or loss if the participant has held the Option Shares for more than one year prior to the date of the sale.

As to the Corporation, the grant of a stock option generally will have no United States income tax consequences, but the Corporation will be entitled to a business-expense deduction in the United States with respect to any ordinary compensation income recognized by a participant as a result of the exercise of a non-statutory stock option.

Canadian Tax Information

The following is a general summary as at the date hereof of certain Canadian federal income tax consequences applicable to individuals who, at relevant times, for purposes of theIncome Tax Act (Canada) are or are deemed to be resident in Canada and who receive Options under the Stock Option Plan by virtue of their employment with the Corporation and the exercise price of the Options is equal to the fair market value of the Common Shares on the date the Options are granted (the "Canadian Resident Employee").

This summary is based upon the current provisions of theIncome Tax Act (Canada) and the regulations enacted thereunder (collectively referred to as the "Canadian Tax Act") as well as our understanding of the current published administrative and assessing policies of the Canada Revenue Agency. This summary is not exhaustive of all possible Canadian federal income tax consequences and does not take into account provincial, territorial or foreign income tax considerations, nor does it take into account or anticipate any changes in law, whether by judicial, governmental or legislative decision or action except the specific proposal (the "Tax Proposals") to amend the Canadian Tax Act publicly announced by or on behalf of the Minister of Finance (Canada) before the date hereof. No assurance can be given that the Tax Proposals will be enacted into law in the manner proposed, or at all.

This summary is of a general nature only and is not exhaustive of all possible Canadian federal income tax considerations related to the exercise of Options or ownership of Common Shares. This summary is not intended to be nor should it be construed to be, legal or tax advice to an particular Canadian Resident Employee. Accordingly, Canadian Resident Employees should consult their own tax advisors with respect to their particular circumstances.

A Canadian Resident Employee who receives options under the Stock Option Plan will not recognize a taxable benefit (the "Benefit") upon the grant of the option. Under section 7 of the Canadian Tax Act, the Benefit is recognized and, unless an election is filed by the Canadian Resident Employee under subsection 7(10) of the Canadian Tax Act, will be included in the employee's employment income, when the Option is exercised. The amount of the Benefit will be the excess of the fair market value of the Option Shares on the exercise date over the exercise price. In computing the employee's taxable income for Canadian tax purposes, an offsetting deduction of one-half of the Benefit is available against the employee's total income.

An employee who makes a "qualifying acquisition" as defined in subsection 7(9) of the Canadian Tax Act may file an election before January 16 of the year following the year in which the Option is exercised to defer the recognition of the Benefit arising from the exercise of Options until the Option Shares are disposed of by the employee, the employee dies, or the employee becomes a non-resident of Canada for purposes of the Canadian Tax Act. The deferral is subject to an annual limit of $100,000, based on the year in which the Option becomes exercisable and on the value of the Common Shares when the Option was granted. A Canadian Resident Employee will be deemed to exercise identical Options in the order designated by the Canadian Resident Employee or in any other case, in the order in which the Options first became exercisable and, in the case of Options that first became exercisable at the same time, in the order in which those Options were acquired under the Stock Option Plan.

The employee's adjusted cost base of the Option Shares is equal to the exercise price plus the amount of the Benefit. Unless an election has been filed under subsection 7(10) in respect of the acquisition of Option Shares, the adjusted costs base of the Option Shares will be averaged with the adjusted cost base of all other Common shares owned by the Canadian Resident Employee. Special rules in the Canadian Tax Act apply to determine the order in which Option Shares and any other Common Shares are disposed

of. Upon the disposition of the Option Shares, the employee will generally recognize a capital gain or loss in amount equal to the difference between the proceeds of disposition of the Option Shares (less any reasonable costs of disposition) and the employee's adjusted cost base of the shares.

As for the Corporation, there are no Canadian income tax consequences with respect to the grant of the stock options. The Corporation will not be entitled to a deduction in Canada with respect to the exercise of stock options even though the employee is deemed to receive a Benefit from the employment.

Information About Proxies

Solicitation of Proxies

The solicitation for proxies will be conducted by mail and may be supplemented by telephone or other personal contact to be made, without special compensation, by officers and employees of the Corporation.The Corporation may retain other persons or companies to solicit proxies on behalf of management, in which event the customary fees for such services will be paid. The cost of the solicitation will be borne by the Corporation.

Appointment of Proxyholder

The personpersons named in the enclosed form of proxy for the Meeting is a director and officerare directors or officers of the Corporation and a nomineeare nominees of management. A shareholder has the right to appoint some other person, who need not be a shareholder, to represent such shareholder at the Meeting by striking out the namenames of the personpersons designated in the accompanying form of proxy and by inserting that other person's name in the blank space provided. If a shareholder appoints one of the personpersons designated in the accompanying form of proxy as a nominee and does not direct the said nominee to vote either for or against or withhold from voting on a matter or matters with respect to which an opportunity to specify how the Common Shares registered in the name of such shareholder shall be voted, the proxy shall be voted in favour of such matter or matters.

4

The instrument appointing a proxyholder must be in writing and signed by the shareholder, or such shareholder's attorney authorized in writing, or if the shareholder is a corporation, by a duly authorized officer, or attorney, of the corporation. An instrument of proxy will only be valid if it is duly completed, signed, dated and received at the office of the Corporation's registrar and transfer agent, Computershare Trust Company of Canada at 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, before 4:30 p.m., Toronto time, on Thursday, May 6, 2004,5, 2005, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting, unless the Chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

Revocation of Proxy

A shareholder may revoke a proxy by delivering an instrument in writing executed by such shareholder or by the shareholder's attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, either to the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting or any adjournment thereof, with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof, before any vote in respect of which the proxy is to be used shall have been taken, or in any other manner permitted by law.

Voting of Proxies

A shareholder may direct the manner in which his or her Common Shares are to be voted or withheld from voting in accordance with the instructions of the shareholder by marking the form of proxy accordingly. If the instructions in a proxy given to management are certain, the Common Shares represented by that proxy will be voted on any poll and where a choice has been specified in the proxy, the Common Shares will be

voted on any poll in accordance with the specifications so made.Where no choice is so specified with respect to any resolution or in the absence of certain instructions, the Common Shares represented by a proxy given to management will be voted in favour of the resolution. If more than one direction is made with respect to any resolution, such Common Shares will similarly be voted in favour of the resolution.

Exercise of Discretion by Proxyholders

The enclosed form of proxy when properly completed and delivered and not revoked confers discretionary authority upon the proxyholderproxyholders named therein with respect to amendments or variations of matters identified in the accompanying Notice of Meeting, and other matters not so identified which may properly be brought before the Meeting. At the date of this Information Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting. If any other matter comes before the Meeting, the personpersons named in the proxy will vote in accordance with their judgement on such matter.

Securities Entitled to Vote

As of March 17, 2004,2005, the authorized share capital of the Corporation is divided into an unlimited number of Common Shares, of which 14,755,07818,218,022 Common Shares are issued and outstanding, and an unlimited number of preferred shares, none of which are issued. Every shareholder who is present in person and entitled to vote at the Meeting shall have one vote on a show of hands and on a poll shall have one vote for each Common Share of which the shareholder is the registered holder, and such shareholder may exercise such vote either in person or by proxyholder.

The Board of Directors of the Corporation has fixed the close of business on March 29, 20042005 as the record date for the purpose of determining the shareholders entitled to receive notice of the Meeting, but the failure of any shareholder to receive notice of the Meeting does not deprive such shareholder of the entitlement to vote at the Meeting. Every shareholder of record at the close of business on March 29, 2004

5

2005 who personally attends the Meeting will be entitled to vote at the Meeting or any adjournment thereof, except to the extent that:

Ownership of the Corporation's Common Shares

Ownership by Management

The following table sets forth certain information regarding beneficial ownership of the Corporation's Common Shares, as of March 17, 2004,2005, by (i) each of the Corporation's executive officers and directors and (ii) the Corporation's executive officers and directors, as a group.

| Name and Address(1) | Common Shares Beneficially Owned(2) | Percentage of Class | Common Shares Beneficially Owned(2) | Percentage of Class | ||||

|---|---|---|---|---|---|---|---|---|

JOHN M. CLARK Director | 65,000 | (3) | * | 80,000 | (3) | * | ||

RONALD J. MCGREGOR President, Chief Executive Officer and Director | 258,500 | (4) | 1.7% | |||||

W. DURAND EPPLER Director | None | * | ||||||

C. THOMAS OGRYZLO Director | 60,000 | (5) | * | 70,000 | (3) | * | ||

ROBERT A. QUARTERMAIN Director | 187,465 | (6) | 1.3% | 172,465 | (4) | 1.0% | ||

MICHAEL B. RICHINGS Director | 105,000 | (7) | * | |||||

All executive officers and directors as a group (5 persons) | 675,965 | 4.4% | ||||||

MICHAEL B. RICHINGS President, Chief Executive Officer andDirector | 115,000 | (3) | * | |||||

GREGORY G. MARLIER Chief Financial Officer | 30,000 | (3) | * | |||||

HOWARD M. HARLAN Vice President, Business Development | 40,000 | (3) | * | |||||

All executive officers and directors as a group (7 persons) | 507,465 | 2.7% | ||||||

* Represents less than 1% of the outstanding Common Shares.

6

Ownership by Principal Shareholders

The following table sets forth certain information regarding beneficial ownership of the Corporation's Common Shares, as of March 17, 2004,2005, by eachthe sole shareholder known to the Corporation to be the beneficial owner of more than 5% of the Corporation's Common Shares.

| Name and Address | Common Shares Beneficially Owned(1) | Percentage of Class | Common Shares Beneficially Owned(1) | Percentage of Class | ||||

|---|---|---|---|---|---|---|---|---|

| Exploration Capital Partners 2000 Limited Partnership, Resource Capital Investment Corporation, Rule Family Trust u/d/t 12/17/98 and Arthur Richards Rule(2) | 2,095,288 | 13.0% | 1,751,381 | 9.1% |

The Corporation has no charter or by-law provisions that would delay, defer or prevent a change in control of the Corporation.

Quorum

Under By-Law No. 1 of the Corporation, the quorum for the transaction of business at the Meeting is two shareholders present in person or by proxy.

The ordinary resolution authorizing the Corporation to amend the Current Plan must be approved by a majority of more than 50% of the votes cast by shareholders who vote in person or by proxy at the Meeting with respect to this resolution. The rules and policies of the TSX further require that the amendment to the Current Plan must be approved by a majority of votes cast at the Meeting other than votes attaching to Common Shares beneficially owned by insiders to whom options under the Current Plan may be issued and their associates. As at the date of this Information Circular, the Corporation understands that a total of 5,000 votes will not be counted for the purposes of determining whether the required level of shareholder approval has been obtained for the amendment to the Current Plan. See "Particulars of Matters to be Acted Upon—Amendment to Stock Option Plan". Directors will be elected by a plurality of the votes cast by shareholders who vote in person or by proxy at the Meeting.

Abstentions will be counted as present for purposes of determining the presence of a quorum for purposes of this matter,these matters, but will not be counted as votes cast. Broker non-votes (shares held by a broker or nominee as to which the broker or nominee does not have the authority to vote on a particular matter) will not be counted as present for purposes of determining the presence of a quorum for purposes of this matterthese matters and will not be voted. Accordingly, neither abstentions nor broker non-votes will have any effect on the outcome of the votes on the matters to be acted upon at the Meeting.

Directors will be elected by a plurality of the votes cast by shareholders who vote in person or by proxy at the Meeting.

Corporate Governance

The Corporation's Board of Directors and executive officers consider good corporate governance to be an important factor in the efficient and effective operation of the Corporation. The Toronto Stock Exchange ("TSX") and the American Stock Exchange ("AMEX") have established guidelines for effective corporate governance. The Board of Directors is of the view that the Corporation's system of corporate governance meets or exceeds these guidelines. A detailed description of how the Corporation's system of corporate governance compares to the corporate governance guidelines established by the TSX is attached asSchedule "A" "C" to this Information Circular.

Committees of the Board of Directors and Meetings

During fiscal 2003,2004, there were three standing committees of the Board of Directors: the Audit Committee; the Corporate Governance Committee; and the Compensation Committee, each described below. Between meetings of the Board of Directors, certain of its powers may be exercised by these standing committees, and these committees, as well as the Board of Directors, sometimes act by unanimous written consent. All of the directors on each committee are "unrelated" within the meaning of the corporate governance guidelines established by the TSX, and are "independent" within the meaingmeaning of AMEX listing standards.

Audit Committee

The Audit Committee is chaired by John M. Clark. Its other members as of the date of this Information Circular are C. Thomas Ogryzlo and W. Durand Eppler (from October 13, 2004). Michael B. Richings as of March 8, 2004. Robert A. Quartermain served on this committee during 2003 and until March 8,October 13, 2004. Its primary function is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing (i) the financial statements, reports and other information provided to shareholders, regulators and others, (ii) the independent auditor's qualifications, independence and performance, (iii) the internal controls that management and the Board have established, and (iv) the audit, accounting and financial reporting processes generally. The Audit Committee met four times during the fiscal year ended December 31, 2003.2004. Additional information about the Audit Committee is contained below under the heading "Audit Committee Report".

Corporate Governance Committee

The Corporate Governance Committee is chaired by C. Thomas Ogryzlo. Its other members as of the date of this Information Circular are John M. Clark and W. Durand Eppler (from October 13, 2004). Michael B. Richings as of March 8, 2004. Robert A. Quartermain served on this committee during 2003 and until March 8,October 13, 2004. The Corporate Governance Committee's functions are to review the Corporation's governance activities and policies in light of the corporate governance guidelines published by the TSX and the AMEX, and also to review proposed nominees for the Board. The Corporate Governance Committee met once during the fiscal year ended December 31, 2003.2004. Additional information about the Corporate Governance Committee is contained above under the heading "Corporate Governance" and inSchedule "AC" to this Information Circular.

The Corporate Governance Committee recommends criteria for service as a director, reviews candidates and recommends appropriate governance practices and compensation for directors. The Committee believes candidates for the Board should have the ability to exercise objectivity and independence in making informed business decisions; extensive knowledge, experience and judgment; the highest integrity; loyalty to the interests of the Corporation and its shareholders; a willingness to devote the extensive time necessary to fulfill a director's duties; the ability to contribute to the diversity of perspectives present in board deliberations; and an appreciation of the role of the corporation in society. The Committee considers candidates meeting these criteria who are suggested by directors, management, shareholders and search firms hired to identify and evaluate qualified candidates. From time to time the Committee recommends highly qualified candidates who are considered to enhance the strength, independence and effectiveness of the Board. Shareholders may submit recommendations in writing by letter addressed to the

Chief Executive Officer or the Chairman of the Corporate Governance Committee. In addition, qualified persons may nominate directors at the Annual General Meeting. Persons qualified to make a nomination must be either a shareholder entitled to vote at this meeting or a proxyholder with a proxy that specifically allows the proxyholder to nominate a director.

The Corporation's Corporate Governance Committee Charter and Code of Ethics are available on the Corporation's website atwww.vistagold.com. The Code of Ethics applies to all directors, officers and employees, including the principal executive, financial and accounting officers. Shareholders may send communications to the Board, the Chairman, or one or more non-management directors by using the

8

contact information provided on the Corporation's website under the headings "Corporate", "Governance", and "Contact the Corporation's Board". Shareholders also may send communications by letter addressed to the Chief Executive Officer of the Corporation at 7961 Shaffer Parkway, Suite 5, Littleton, CO 80127 or by contacting the Chief Executive Officer at (720) 981-1185. All communications addressed to the Chief Executive Officer will be received and reviewed by that officer. The receipt of concerns about the Corporation's accounting, internal controls, auditing matters or business practices will be reported to the Audit Committee. The receipt of other concerns will be reported to the appropriate Committee(s) of the Board.

The President and Chief Executive Officer is required to attend the Annual General Meeting; attendance by other directors is discretionary. The President and Chief Executive Officer and one other memberAll members of the Board of Directors attended the 20032004 Annual General Meeting.

Compensation Committee

The Compensation Committee is chaired by John M. Clark. Its other members as of the date of this Information Circular are C. Thomas Ogryzlo and W. Durand Eppler (from October 13, 2004). Michael B. Richings as of March 8, 2004. Robert A. Quartermain served on this committee during 2003 and until March 8,October 13, 2004. The Compensation Committee's functions are to review and recommend compensation policies and programs to the Corporation as well as salary and benefit levels for its executives. The Compensation Committee met twice during the fiscal year ended December 31, 2003.2004. Additional information about the Compensation Committee is contained under the heading "Executive Compensation—Report of the Compensation Committee".

Meetings of the Board of Directors

During the fiscal year ended December 31, 2003,2004, the Board of Directors met 10eight times. Each director attended at least 75% of the total number of each of the meetings of the Board of Directors and the meetings of the committees on which he served.

Audit Committee Report

The Audit Committee of the Board of Directors is responsible for providing independent, objective oversight of the Corporation's accounting functions and internal controls. The Audit Committee acts under a written charter first adopted and approved by the Board of Directors in 2001, as amended in 2004,2005, which is reviewed annually. Each of the members of the Audit Committee is "independent" within the meaning of the AMEX listing standards. During 2003, inIn accordance with Section 407 of the United StatesSarbanes-Oxley Act of 2002, the Board of Directors has identified John M. Clark as the "Audit Committee Financial Expert." A copy of the Audit Committee charter is attached hereto asSchedule "BD".

The responsibilities of the Audit Committee include recommending to the Board of Directors an accounting firm to be engaged as the Corporation's independent accountants. The Audit Committee is responsible for recommending to the Board of Directors that the Corporation's financial statements be included in its annual report. The Audit Committee took a number of steps in making this recommendation for fiscal year 2003.2004. First, the Audit Committee discussed with PricewaterhouseCoopers LLP those matters required to be discussed by Statement on Auditing Standards. Standards

No. 61, including information regarding the scope and results of the audit. These communications and discussions are intended to assist the Audit Committee in overseeing the financial reporting and disclosure process. Second, the Audit Committee discussed with PricewaterhouseCoopers LLP the independence of PricewaterhouseCoopers LLP and received from PricewaterhouseCoopers LLP the letter required by Independence Standards Board Standard No. 1, concerning theirits independence as required under applicable independence standards for auditors of public companies. This discussion and disclosure assisted the Audit Committee in evaluating such independence. Finally, the Audit Committee reviewed and discussed, with the Corporation's management and PricewaterhouseCoopers LLP, the Corporation's

9

audited consolidated balance sheets at December 31, 2003,2004, and consolidated statements of income, cash flows and shareholders' equity for the fiscal year ended December 31, 2003.2004. Based on the discussions with PricewaterhouseCoopers LLP concerning the audit, the independence discussions, the financial statement review, and such other matters deemed relevant and appropriate by the Audit Committee, the Audit Committee recommended to the Board of Directors that the Corporation's financial statements be included in its 20032004 Annual Report on Form 10-K.

Submitted on behalf of the Audit Committee | ||

JOHN M. CLARK (Chairman) C. THOMAS OGRYZLO |

Executive Compensation

Summary Compensation Table

The table below contains a summary of the compensation paid to, or earned by, the Corporation's President and Chief Executive Officer, the Chief Financial Officer and the Corporation's most highly compensated executive officerofficers (other than the President and Chief Executive Officer and the Chief Financial Officer) who was either serving as an executive officer during or at the end of the Corporation's most recently completed financial year and during such year received, in his capacity as officer of the Corporation and any of its subsidiaries, in excess of Cdn.$100,000150,000 including salary, stock options and other compensation (collectively, the "Named Executive Officers"), for each of the Corporation's three most recently completed financial years ended December 31, 2004, 2003 and 2002 and 2001.as applicable. All currency figures under the heading "Summary Compensation Table" are in United States dollars.

Summary Compensation Table

| | | Annual Compensation | Long-Term Compensation | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary (U.S.$) | Bonus (U.S.$) | Other Annual Compensation(1) (U.S.$) | Number of Common Shares under Options Granted(2) (#) | All Other Compensation(3) (U.S.$) | ||||||||||

RONALD J. MCGREGOR(4) Former President and Chief Executive Officer | 2004 2003 2002 | 69,541 166,900 166,900 | 20,000 10,000 nil | 26,507 nil nil | nil | 2,781 6,676 6,000 | ||||||||||

President and Chief Exeutive Officer | 2004 2003 2002 | 116,197 N/A N/A | nil N/A N/A | nil N/A N/A | nil N/A N/A | nil N/A N/A | ||||||||||

| GREGORY G. MARLIER(6) Chief Financial Officer | 2004 2003 2002 | 64,176 N/A N/A | nil N/A N/A | nil N/A N/A | 60,000 N/A N/A | 917 N/A N/A | ||||||||||

| HOWARD M. HARLAN(7) Vice President, Development | 2004 2003 2002 | 81,004 | nil N/A N/A | nil N/A N/A | 10,000 | 2,277 | ||||||||||

10

Long-Term Incentive Plan

The Corporation does not presently have a long-term incentive plan for its Named Executive Officers.

Stock Options

The Corporation has established a Stock Option Plan which provides for grants to directors, officers, employees and consultants of the Corporation, or its subsidiaries, of options to purchase Common Shares. Subject to applicable stock exchange requirements, under the Stock Option Plan, a maximum of one million Common Shares may be reserved, set aside and made available for issue under, and in accordance with, the Stock Option Plan, and the maximum number of Common Shares that may be reserved for issuance to any individual under the Stock Option Plan is that number of Common Shares that is equivalent to 5% of the Common Shares issued and outstanding from time to time. Under the Stock Option Plan, options may be exercised by the payment in cash of the option exercise price to the Corporation. All options are subject to the terms and conditions of an option agreement entered into by the Corporation and each participant at the time an option is granted.

The Stock Option Plan is administered by the Board of Directors which has full and final discretion to determine (i) the total number of optioned shares to be made available under the Stock Option Plan, (ii) the directors, officers, employees and consultants of the Corporation who are eligible to receive stock options under the Stock Option Plan ("Optionees"), (iii) the time when and the price at which stock options will be granted, (iv) the time when and the price at which stock options may be exercised, and (v) the conditions and restrictions on the exercise of options. Pursuant to the terms of the Stock Option Plan, the exercise price must not be less than the closing price of the Common Shares on either the AMEX or the TSX, at the Board of Directors' discretion, on the day preceding the date of grant. Options become exercisable only after they vest in accordance with the respective stock option agreement and must expire no later than ten years from the date of grant.

If an Optionee ceases to be an officer or employee of the Corporation, or its subsidiaries, as a result of termination for cause, all unexercised options will immediately terminate. If an Optionee ceases to be a director, officer or employee of the Corporation, or its subsidiaries, or ceases to be a consultant to the Corporation, for any reason other than termination for cause, the Optionee shall have the right to exercise his or her options at any time up to but not after the earlier of 30 days from the date of ceasing to be a director, officer, employee or consultant, or the expiry date. In the event of death of an Optionee, the legal representatives of such Optionee have the right to exercise the options at any time up to but not after the earlier of 90 days from the date of death, or the expiry date.

Options granted under the Stock Option Plan are non-transferable and non-assignable other than on the death of a Participant. An Optionee has no rights whatsoever as a shareholder in respect of unexercised options.

Stock Option Grants

A summary of stock options granted to the Named Executive Officers under the Stock Option Plan during the financial year ended December 31, 20032004 is set out in the table below. All stock options are for Common Shares of the Corporation. No stock appreciation rights ("SARs") are outstanding, and it is currently intended that none be issued.

11

| Name | Number of Securities Under Option (#) | % of Total Options Granted to Employees in Financial Year (%) | Exercise or Base Price ($/Security) | Market Value of Securities Underlying Options on the Date of Grant ($/Security)(1) | Expiry Date (m/d/y) | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term 5%/10% ($) | Number of Securities Under Option (#) | % of Total Options Granted to Employees in Financial Year (%) | Exercise or Base Price ($/Security) | Market Value of Securities Underlying Options on the Date of Grant ($/Security)(1) | Expiry Date (m/d/y) | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term 5%/10% ($) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RONALD J. MCGREGOR | 10,000 | 9% | Cdn.$ | 4.53 | Cdn.$ | 4.53 | 03/10/08 | Cdn.$ | 12,500/27,500 | None | N/A | N/A | N/A | N/A | N/A | |||||||||||||||

RONALD J. MCGREGOR | 20,000 | 18% | U.S.$ | 4.40 | U.S.$ | 4.40 | 12/18/08 | U.S.$ | 24,500/54,000 | |||||||||||||||||||||

JOHN F. ENGELE(2) | 10,000 | 9% | Cdn.$ | 4.53 | Cdn.$ | 4.53 | — | — | ||||||||||||||||||||||

| MICHAEL B. RICHINGS(2) | 130,000 | 42% | $ | 4.19 | $ | 4.19 | 11/08/09 | $ | 150,000/332,545 | |||||||||||||||||||||

| GREGORY G. MARLIER | 60,000 | 19% | $ | 3.43 | $ | 3.43 | 08/08/09 | $ | 56,850/125,640 | |||||||||||||||||||||

| HOWARD M. HARLAN | 10,000 | 3% | $ | 3.74 | $ | 3.74 | 05/07/09 | $ | 10,333/22,833 | |||||||||||||||||||||

| HOWARD M. HARLAN(2) | 20,000 | 6% | $ | 4.19 | $ | 4.19 | 11/08/09 | $ | 23,152/51,161 | |||||||||||||||||||||

The reported high and low trading prices of the Corporation's Common Shares on the TSX and the AMEX for the 30 days prior to the date of the grants of the options referred to above are set out in the table below.

| | Toronto Stock Exchange | American Stock Exchange | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | High | Low | High | Low | ||||||||

| February 7 to March 8, 2003 | Cdn.$ | 6.90 | Cdn.$ | 4.45 | U.S.$ | 4.55 | U.S.$ | 3.00 | ||||

| November 18 to December 17, 2003 | Cdn.$ | 6.99 | Cdn.$ | 5.31 | U.S.$ | 5.25 | U.S.$ | 3.82 | ||||

| | Toronto Stock Exchange | American Stock Exchange | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | High | Low | High | Low | ||||||||

| July 7 to August 6, 2004 | Cdn.$ | 5.69 | Cdn.$ | 4.14 | U.S.$ | 4.20 | U.S.$ | 3.18 | ||||

| October 6 to November 5, 2004 | Cdn.$ | 5.74 | Cdn.$ | 4.75 | U.S.$ | 4.53 | U.S.$ | 3.75 | ||||

Aggregated Option Exercises and Value of Unexercised Options

A summary of the exercise of options by the Named Executive Officers during the financial year ended December 31, 20032004 and the value at December 31, 20032004 of unexercised in-the-money options held by the

Named Executive Officers issued is set out in the table below. No SARs are outstanding. All currency figures underin the heading "Aggregated Option Exercises and Value of Unexercised Options"table are in CanadianUnited States dollars.

Aggregated Option Exercises During the Most Recently Completed Financial Year

and Financial Year-End Option Values

| Name | Securities Acquired on Exercise (#) | Aggregate Value Realized ($) | Unexercised Options at Financial Year-End Exercisable/Unexercisable (#) | Value of Unexercised in-the-Money Options at Financial Year-End Exercisable/Unexercisable(1) ($) | Securities Acquired on Exercise (#) | Aggregate Value Realized ($) | Unexercised Options at Financial Year-End Exercisable/Unexercisable (#) | Value of Unexercised in-the-Money Options at Financial Year-End Exercisable/Unexercisable(1) ($) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RONALD J. MCGREGOR | 17,500 | U.S.$ | 79,993 | 237,500/0 | Cdn.$1,341,875/0 | 229,642 | $ | 278,854 | 17,858/0 | $67,860/0 | ||||||||

RONALD J. MCGREGOR | 10,000/10,000 | U.S.$44,400/44,400 | ||||||||||||||||

JOHN F. ENGELE(2) | 71,250 | U.S.$ | 79,551 | nil | nil | |||||||||||||

| MICHAEL B. RICHINGS(2) | None | N/A | 115,000/130,000 | $437,000/$494,000 | ||||||||||||||

| GREGORY G. MARLIER | None | N/A | 30,000/30,000 | $114,000/$114,000 | ||||||||||||||

| HOWARD M. HARLAN | None | N/A | 35,000/25,000 | $133,000/$95,000 | ||||||||||||||

12

Pension and Retirement Savings Plans

The Corporation sponsors a qualified tax-deferred savings plan in accordance with the provisions of Section 401(k) of the U.S. Internal Revenue Code, which is available to permanent U.S.-based employees. Under the terms of this plan, the Corporation makes contributions of up to 4% of eligible employees' salaries.

Termination of Employment, Change in Responsibilities and Employment Contracts

Ronald J. McGregor the

Ronald J. McGregor, President and Chief Executive Officer has beenuntil his death on May 24, 2004, was engaged under an employment contract. ThisAs previously disclosed in filings by the Corporation, this contract providesprovided for base salary, annual discretionary incentive bonus, four weeksweeks' vacation time and various minor perquisites.

Michael B. Richings

Michael B. Richings, President and Chief Executive Officer from May 25, 2004, has been engaged under an employment contract effective January 1, 2005. This contract provides for base salary of $160,000, annual discretionary incentive bonus, five weeks' vacation time and various minor perquisites.

The contract between the Corporation and Mr. McGregorRichings is for an unlimited term, provides for an annual bonus at the sole discretion of the Board of Directors and provides for the severance benefit described below. Under the terms of this contract, the employment of Mr. McGregorRichings may be terminated by the Corporation without cause, provided that it continues to pay his base salary for a period of 12 months (or makes a lump sum payment equal to 12 months of his base salary),following termination, and by Mr. McGregorRichings upon 30 daysdays' notice to the Corporation. In addition, in the event thatof a "substantial adverse change" (as defined below) in Mr. McGregor suffers an injury or illness that renders him permanently incapable of substantially performing his duties under this contract,Richings' employment without cause, the Corporation may terminate Mr. McGregor's employment, provided that it continuesmust continue to pay his base salary and other employee benefits for a period of 12 months following noticethe occurrence of the substantial adverse change. In the case of either termination without cause or occurrence of the "substantial adverse change" without cause, Mr. Richings may elect to receive a lump

sum payment equal to 12 months of salary, vacation pay, employer contribution to his retirement savings plan, and employer-paid benefits.

As used in the employment agreement, "substantial adverse change" means a material adverse change in any of the duties, powers, salaries or benefits of Mr. Richings, or a diminution of his title, as compared to the status of such termination.matters at the effective date of the agreement.

Gregory G. Marlier

Gregory G. Marlier, Chief Financial Officer of the Corporation, has been engaged under an employment contract effective June 1, 2004. This contract provides for base salary of $110,000, an initial grant of a five-year option to purchase 60,000 Common Shares of the Corporation, an annual discretionary incentive bonus, four weeks' vacation time and various minor perquisites.

The contract between the Corporation hasand Mr. Marlier is for an arrangement withunlimited term, provides for an annual bonus at the sole discretion of the Board of Directors and provides for the severance benefit described below. Under the terms of this contract, the employment of Mr. McGregor under which he is entitledMarlier may be terminated by the Corporation without cause, provided that it continues to receive severance benefits basedpay his base salary for a period of three months following termination, and by Mr. Marlier upon his monthly salary30 days' notice to the Corporation. In addition, in the event of a "fundamental change" (as defined below) in Mr. Marlier's employment without cause, the Corporation must continue to pay his base salary and other employee benefits for a period of three months following the occurrence of the fundamental change. In the case of either termination without cause or occurrence of a "fundamental change" without cause, Mr. Marlier may elect to receive a lump sum payment equal to three months of salary, vacation pay, employer contribution to his retirement savings plan, and employer-paid benefits.

As used in the employment agreement, "fundamental change" means an adverse change in any of the duties, powers, salary or benefits of Mr. Marlier, or a diminution of his title, or a change in the metropolitan area in which Mr. Marlier is regularly required to carry out the terms of his employment, other than for cause. The compensation payableas compared to Mr. McGregor under this arrangement is U.S.$166,900.the status of such matters at the effective date of the agreement.

Other than as described above, the Corporation has no plan or arrangement in respect of compensation received or that may be received by Named Executive Officers to compensate such officers in the event of the termination of employment, resignation, retirement, change of control of the Corporation or in the event of a change in responsibilities following a change of control.

Compensation Committee Interlocks and Insider Participation

TheAs of the date of this Information Circular, the Corporation has a Compensation Committee comprised of the following directors: John M. Clark (Chairman), C. Thomas Ogryzlo and W. Durand Eppler. Michael B. Richings as of March 8, 2004. Robert A. Quartermain served on this committee during 2003 and until March 8,October 13, 2004. None of the members of the Compensation Committee is or has been an executive officer or employee of the Corporation or any of its subsidiaries or affiliates with the exception of Michael B. Richings, who washas served as President and Chief Executive Officer of the Corporation from May 25, 2004, initially in an interim capacity and then on a permanent basis effective January 1, 2005. He had previously served in those capacities from 1995 until September 2000. No executive officer of the Corporation is or has been a director or a member of the Compensation Committee of another entity having an executive officer who is or has been a director or a member of the Compensation Committee of the Corporation.

Report of the Compensation Committee on Executive Compensation

It is the responsibility of the Compensation Committee to review and recommend compensation policies and programs to the Corporation as well as salary and benefit levels for its executives. The committee makes recommendations to the Board of Directors which gives final approval on compensation matters.

The Corporation's compensation policies and programs are designed to be competitive with similar mining companies and to recognize and reward executive performance consistent with the success of the Corporation's business. These policies and programs are intended to attract and retain capable and experienced people.

13

In addition to industry comparables, the Compensation Committee considers a variety of factors when determining both compensation policies and programs and individual compensation levels. These factors include the long-range interests of the Corporation and its shareholders, overall financial and operating performance of the Corporation and the committee's assessment of each executive's individual performance and contribution toward meeting corporate objectives. Superior performance is recognized through the Corporation's incentive policy.

The total compensation plan for executive officers is comprised of three components: base salary, an incentive payment and stock options. As a general rule for establishing base salaries, the Compensation Committee reviews competitive market data for each of the executive positions and determines placement at an appropriate level in a range. Compensation levels are typically negotiated with the candidate for the position prior to his or her final selection as an executive officer. The compensation range for executives normally moves annually to reflect external factors such as inflation.

The Corporation's incentive policy generally allows executive officers and management personnel to earn an incentive payment to a maximum of 15% of his or her base salary, two-thirds of which is based upon individual performance and one-third of which is based upon the performance of the Corporation. All executive officers and management personnel participate in this policy, except the President and Chief Executive Officer. By contract, he is entitled to earn a bonus the amount of which is at the sole discretion of the Board of Directors. Following the end of each fiscal year, the Compensation Committee makes a recommendation to the Board of Directors as to the appropriate incentive payment for the executive officers and management personnel. No specific performance criteria or objectives are utilized by the Compensation Committee or the Board of Directors in making their determinations. In 2003,2004, incentive payments totalling U.S.$31,500$26,070 were paid to executive officers and employees of the Corporation.

The third element in the total compensation plan is the Stock Option Plan. This plan is intended to emphasize management's commitment to growth of the Corporation and enhancement of shareholders' wealth through, for example, improvements in net earnings, resource base, and share price increments.

The compensation of Ronald J. McGregor, the President and Chief Executive Officer of the Corporation is determined in the same manner as for other executive officers (as described above). Under the employment contract between the Corporation and Mr. Richings, which has substantially the same provisions as did the employment contract between the Corporation and Mr. McGregor, Mr. McGregorRichings is entitled to receive a base salary, an annual discretionary incentive bonus, four weeksfive weeks' vacation time and various minor perquisites. In addition, Mr. McGregorRichings is entitled to receive stock options under the Stock Option Plan. During 2003,2004, Mr. McGregor received only cash as an incentive bonus prior to his untimely death in May 2004. Mr. Richings received cash and stock options as an incentive bonus.during 2004. Further details regarding the compensation received by Mr. McGregor and Mr. Richings during 20032004 are outlined above under "Executive Compensation—Summary Compensation Table".

Submitted on behalf of the Compensation Committee | ||

JOHN M. CLARK (Chairman) C. THOMAS OGRYZLO |

14

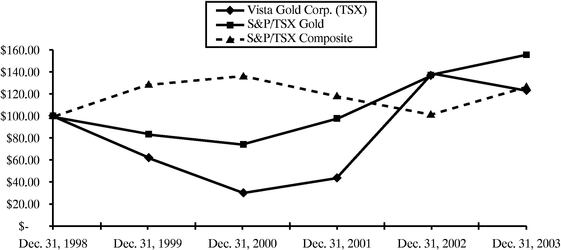

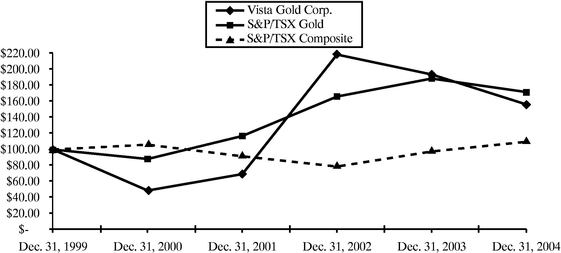

Performance Graph

The following graph compares the yearly percentage change in the Corporation's cumulative total shareholder return on its Common Shares with the cumulative total return of the S&P/TSX Composite Index and the S&P/TSX Canadian Gold Index, assuming the reinvestment of dividends, for the last five financial years:

The Common Shares were consolidated on a 20:1 basis on June 19, 2002; values after that date have been adjusted to reflect the consolidation.

Compensation of Directors and Officers

On December 30, 1997, the Board of Directors resolved to waive annual fees for non-management directors of the Corporation effective January 1, 1998 until such time as the directors determine otherwise. During the financial year ended December 31, 2003,2004, directors of the Corporation received a fee of Cdn.$1,000 per meeting of the Board of Directors for in-person attendance and Cdn.$500 per meeting for attendance by telephone call-in. At the November 9, 2004, Board of Directors meeting the directors' fee was changed to U.S.$1,200 per meeting for in-person attendance as well as for telephone call-in where the meeting of the full Board of Directors was held in conjunction with committee meetings; and U.S.$1,000 for in-person or telephonic attendance, if only a meeting of the full Board of Directors was held. The Corporation also reimbursedreimburses directors for out-of-pocket expenses related to their attendance at meetings. No additional amounts were paid or are payable to directors of the Corporation for committee participation or special assignments.

The total aggregate cash remuneration paid or payable by the Corporation and its subsidiaries during the financial year ended December 31, 20032004 (i) to the directors of the Corporation in their capacity as directors of the Corporation and any of its subsidiaries was U.S.$37,500,26,243, and (ii) to the officers of the Corporation and any of its subsidiaries who received in their capacity as officers or employees of the Corporation aggregate remuneration in excess of Cdn.$40,000 was U.S.$207,652.332,681.40. This sum includes compensation paid to executive officers pursuant to the cash incentive plan and retirement savings plan.

Securities Reserved For Issuance Under Equity Compensation Plans

The following table sets out information relating to the Corporation's equity compensation plans as at December 31, 2004.

| Plan Category | Number of securities to be issued upon exercise/conversion of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by securityholders | 883,483 | (1) | $ | 3.07 | 388,214 | (2) | ||

| Equity compensation plans not approved by securityholders | N/A | N/A | N/A | |||||

| Total | 883,483 | $ | 3.07 | 388,214 | ||||

Indebtedness of Directors and Senior Officers

None of the directors, nor any individual who was at any time during the most recently completed financial year a director, or any associates or affiliates of the foregoing persons is indebted to the Corporation.

Director and Officer Liability Insurance

The Corporation has purchased and maintains insurance in the amount of Cdn.U.S.$5 million for the benefit of the directors and officers of the Corporation against liabilities incurred by such persons as directors and officers of the Corporation and its subsidiaries, except where the liability relates to such person's failure to act honestly and in good faith with a view to the best interests of the Corporation. The annual premium paid by the Corporation for this insurance in respect of the directors and officers as a group is Cdn.U.S.$90,000.74,227. No premium for this insurance is paid by the individual directors and officers. The insurance

15

contract underlying this insurance does not expose the Corporation to any liability in addition to the payment of the required premiums.

Interest of Management and Others in Material Transactions

Except as described below, no director or senior officer of the Corporation who has served in such capacity since the beginning of the last financial year, and to the best of the knowledge of the Corporation, no person that has direct or indirect beneficial ownership of more than 5% of the issued Common Shares of the Corporation and no associate or affiliate of any such person, had any material interest, directly or indirectly, in any transaction within the past three years,year, or in any proposed transaction, which has affected or would materially affect the Corporation or any of its subsidiaries.

In September 2004, the Corporation completed a private placement transaction for gross proceeds of $6.5 million. The Corporation retained Global Resource Investments Ltd. (defined above as "Global") and paid Global a cash commission equal to $324,465 as consideration for Global's services as finder. In addition, the Corporation paid Global a total of $18,757 representing the legal costs incurred by Global in connection with this private placement.

The Corporation understands that all of the outstanding shares of Global are beneficially owned by Mr. A. Richards Rule, and that Mr. Rule beneficially owns approximately 9.1% of the Common Shares of the Corporation. See "Ownership of the Corporation's Common Shares".

On June 9, 2003, the Corporation entered into an agreement granting Silver Standard Resources Inc. ("SSRI") an option to acquire the Corporation's interest in the silver resources hosted in the Maverick Springs project. Pursuant to this agreement, SSRI willwould pay U.S.$1.5$1.5 million over four years, including a payment of U.S.$300,000$300,000 that was made upon acceptance of the option agreement for filing on the TSX. The remaining U.S.$1.2$1.2 million willwould be used to fund exploration programs, land holding costs and option payments. As of December 31, 2004, SSRI has paid the Corporation $1,377,976 pursuant to this agreement. SSRI and the Corporation have formed a committee to jointly manage exploration of the Maverick Springs project. Robert A. Quartermain is a director of both SSRI and the Corporation.

In February 2003, the Corporation completed a private placement of special warrants for gross proceeds of U.S.$3,402,000 (the "Special Warrant Offering"). The Corporation retained Global Resource Investments Ltd. (defined above as "Global") and paid Global a cash commission equal to U.S.$340,020 as consideration for Global's services as finder. In addition, the Corporation paid Global a total of Cdn.$21,621.88 representing the legal costs incurred by Global in connection with the Special Warrant Offering.

In February and March 2002, the Corporation completed a private placement transaction for gross proceeds of approximately U.S.$3.8 million. Global acted as the Corporation's agent with respect to this transaction, and was issued a total of 296,296 Common Shares and warrants to acquire an additional 296,296 Common Shares (such numbers after giving effect to the consolidation of the Corporation's Common Shares made effective on June 19, 2002) as consideration for its services as agent. Shareholders approved this transaction, including the issuance of these Common Shares and warrants to Global, at the Corporation's annual and special general meeting held in April 2002.

The Corporation understands that all of the outstanding shares of Global are beneficially owned by Mr. A. Richards Rule, and that Mr. Rule beneficially owns approximately 13% of the Common Shares of the Corporation. See "Ownership of the Corporation's Common Shares".

Management Contracts

There are no management functions of the Corporation which are to any substantial degree performed by persons other than the directors, senior officers or managers of the Corporation. The Corporation has entered into employment agreements with each of Michael B. Richings, President and Chief Executive Officer, and Gregory G. Marlier, Chief Financial Officer, as set forth above under "Termination of Employment, Change in Responsibilities and Employment Contracts."

Interest of Certain Persons in Matters to be Acted Upon

Other than as disclosed herein, no person who has been a director or officer of the Corporation at any time since the beginning of the last financial year or any proposed nominee for election as director, nor any associate or affiliate of such person, has an interest in the matters to be acted upon at the Meeting.

Shareholder Proposals

Under the Exchange Act,, the deadline for submitting shareholder proposals for inclusion in the management information and proxy circular for an annual meeting of the Corporation is calculated in accordance with Rule 14a-8(e)(3) of Regulation 14A to that Act. If the proposal is submitted for a

16

regularly scheduled annual meeting, the proposal must be received at the Corporation's principal executive offices not less than 120 calendar days before the date of the Corporation's management information and proxy circular released to the Corporation's shareholders in connection with the previous year's annual meeting. However, if the Corporation did not hold an annual meeting the previous year, or if the date of the current year's annual meeting has been changed by more than 30 days from the date of the previous year's meeting, then the deadline is a reasonable time before the Corporation begins to print and mail its proxy materials. Accordingly, unless the date of the next annual meeting is changed by more than 30 days from the date of this year's meeting the deadline for submitting shareholder proposals for inclusion in the management information and proxy circular for the next annual meeting of the Corporation will be December 2, 2004.29, 2005.

Other Matters

Management of the Corporation knows of no other matters, which will be brought before the Meeting other than those set forth in the Notice of Meeting. Should any other matters properly come before the Meeting, the Common Shares represented by the proxies solicited hereby will be voted on those matters in accordance with the best judgement of the persons voting such proxies.

Dissenters' Rights of Appraisal

No action is proposed herein for which the laws of the Yukon Territory, the Articles of Continuation or By-laws of the Corporation provide a right of a shareholder to dissent and obtain appraisal of or payment for such shareholder's Common Shares.

Section 16(a) Beneficial Ownership Reporting Compliance